Brexit vs. eCommerce

Article topics

- The potential impact of no-deal

- Customs

- Delivering to the EU

- VAT

- Fulfilled by Amazon

- Reducing border friction

- No-deal Brexit eCommerce checklist

- Resources to help you plan

- Final thought

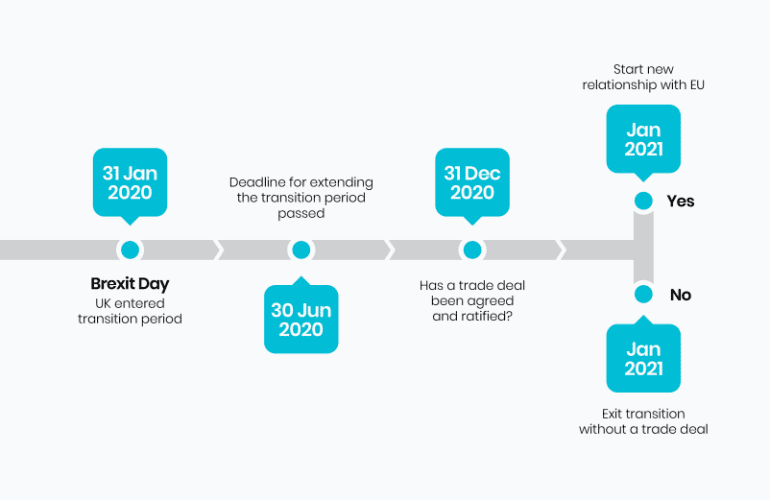

With the Covid crisis taking up most of news media bandwidth since March, Brexit has receded from the headlines. However, the UK is fast approaching the deadline for parting company with the EU. On the 1st January 2021 we will separate from the EU either with or without a trade deal:

Brexit timeline

Boris Johnson has put a positive spin on a no-deal Brexit, saying that it will give the UK the “freedom to do trade deals with every country in the world” and that we will “prosper mightily as a result”. That’s easy to say, and may well be true, but what does it actually mean for UK eCommerce brands and business who want to continue selling products into the EU if we exit without a trade deal?

If a deal isn’t reached, then the UK will default to World Trade Organisation (WTO) terms. This means that every country in the world that you want to sell into will have its own rules. Equally, the UK will apply its own rules on goods entering the country, from the EU and anywhere else in the world.

The potential impact of no-deal

For UK eCommerce businesses, the issue is the movement of products to consumers in EU countries. Some of the main concerns are about VAT, customs and taxes, and the effect that the UK no longer being part of the EU will have on customers inside the EU and the relationship with EU partners and suppliers.

Customs

If the UK parts with the EU without a deal in place, eCommerce businesses will lose the benefits of being in an EU member state (and vice versa). VAT rules will change, and duties, taxes and other tariffs may be payable on products sold into the EU. With a no-deal Brexit will come the reinstatement of customs borders, which could mean longer shipping times as friction at ports increases.

Currently, UK/EU customs arrangements enable eCommerce businesses to sell products freely in the EU. This means that until the beginning of 2021 UK online traders are not required to make customs export declarations when selling products within the EU. This will change after 31st December 2020. Unless a deal is reached, you’ll need to make customs declarations when exporting goods to the EU. These rules currently apply to exporting goods to the rest of the world and some European countries, including Switzerland, Norway, Iceland and Liechtenstein.

Delivering to the EU

Many eCommerce businesses use fast parcel couriers such as FedEx, UPS, DHL etc. These types of courier can deal with post-Brexit customs for eCommerce businesses as part of their day-to-day delivery service.

In order to do this, you will need to have an Economic Operator and Identification scheme number (EORI). Your courier can help you with this or you can apply online. Usually, you won’t need an EORI if your business only offers services or you are shipping products between NI and ROI.

If you sell online B2B, you might choose a freight forwarder instead of a courier. A freight forwarder will arrange clearing your products through customs—their systems will be integrated with HMRC.

If you sell smaller, lighter products you won’t need a freight forwarder, but if you sell large items or wholesale lots of products to a single customer, then freight forwarding services might be right for you. Find out more about freight forwarding.

A way to avoid customs and potential hold ups at ports is to dropship. Your business would be in the UK and your distribution centre would be in the EU, where your products are stored and dispatched from an EU country. Dropshipping won’t be a good fit for every online retailer. It will depend on the types of products you sell and your business goals. Find out more about post-Brexit drop shipping.

VAT

When exporting products from the UK to the EU after 31st December 2020 the same rules will apply as currently do for exporting to non-EU countries—consumers are not charged VAT. Until the end of the year VAT is charged on products sold to consumers in the EU below ‘distance selling thresholds’, but with a no-deal Brexit at the end of the year the EU will for the UK be under the same VAT rules as current non-EU countries.

This applies to goods only. For services, the ‘place of supply’ rules determine the country in which you need to charge and account for VAT.

Current EU rules would mean that EU member states will treat products entering the EU from the UK in the same way as products entering from other non-EU countries. Associated import VAT and customs duties would be due when the goods arrive into the EU.

Fulfilled by Amazon

If your business uses Amazon marketplace FBA, then the rules will change with a no-deal Brexit. Amazon’s UK FBA services will be divided from the EU with and end to EFN (European Fulfilment Network) and an end to Pan-European FBA inventory movement between the UK and EU.

Officially Amazon says that the changes will apply from the 1st of January 2021. In actual fact you might find the Amazon FBA Brexit changes begin to impact sooner. For example, if you have inventory in Pan-European FBA it is possible that Amazon will repatriate your stock before the end of the year and certainly is likely to stop sending your stock to the EU at an earlier date. This means that certainly around Christmas, perhaps sooner, your EU Amazon sales will likely start to decline.

Of course, this applies equally to EU eCommerce businesses that use Amazon FBA services, as it does to eCommerce businesses from elsewhere in the world. Provision will need to be made to split inventory between UK and EU.

Reducing border friction

If you sell B2B then you might send some goods to the EU as freight. The UK government has agreed to stay in the Common Transit Convention (CTC) after Brexit to help reduce EU cross-border friction. It reduces the need for additional import/export documentation when moving goods across multiple customs territories. For example, any payment charges due on goods will only be required in their destination country.

The CTC can also offer cashflow advantages by allowing the movement of goods across territories—businesses in countries that are not in the CTC have to pay each time their goods crossed a border. Find out more about the CTC.

No-deal Brexit eCommerce checklist

- Do you have a UK EORI number?

- You’ll need to get an EU EORI number if you’re exporting to your own business within the EU—you can get one from the customs authority in any EU country.

- Have you factored for the impact of potential shipping delays on your customers, particularly if you export perishable goods, are part of a just-in-time supply chain or commit to same-day or next-day delivery?

- Have you thought about moving forwards or pushing back your scheduled delivery dates to avoid the transition deadline?

- Have you spoken to your logistics provider about how to make customs declarations?

- Have you familiarised yourself with VAT rules for exporting to the EU and considered any cash flow implications?

- Have you checked what you need for the types of goods you export—there may be specific licences or rules for certain products?

- Have you considered how the Common Transit Convention (CTC) might benefit your business?

Resources to help you plan

- Explore the government’s advice for getting ready to export goods, and specific advice on transporting goods out of the UK by road.

- The EU has published a communication on the readiness for 1st January – with sections on customs and trade in goods.

- Find out your Economic Operator Registration and Identification (EORI) number. This will make it easier to trade with the EU after no deal.

- Find out how to claim VAT refunds from EU countries after no deal.

Final thought

Whether you believe that Brexit is a good thing or a bad thing, the reality is that we are leaving. And that requires UK eCommerce businesses to act now to continue to trade in EU countries.

Planning for the changes in how your EU customer orders will be fulfilled is vital to mitigate the impact of exiting the EU. Having a strategy in place to ensure that your products are delivered on time, and that your business is complying with movement of goods and tax regulations, will ensure that you are well prepared for post Brexit trade with the EU, and indeed the rest of the world.

Trading across international borders is crucial for opening up additional revenue streams. Reaching international consumers with your brand and products, communicating with them at a local level, and offering them outstanding shopping experiences, will create an extended loyal customer base and help increase and sustain bottom line growth.

If you would like to know more about trading with EU countries in 2021 or would like to extend your business reach into the global marketplace, then get in touch today for a chat with one of our eCommerce experts.

Back

Back